From Niche to Necessity: Building a New System of Record

Seven strategies for competing in a crowded landscape of incumbent systems of record

I recently wrote about what I call Central Records, which, to my surprise and delight, resonated with a lot of folks and led to a number of interesting conversations.

The idea behind Central Records is that the standard dialogue about Systems of Record (SOR) — large enterprise software products that are core to businesses and therefore hard to rip out — misses a key point. These systems aren’t just stores of enterprise data with some workflow; they are built around a central data object, record, or persona. For example, Rippling isn’t just a core HR system—their products are built around the employee object. This focus allows Rippling to deeply understand the employee persona, build everything they need, and ultimately create a large surface area, venture-scale product.

Understanding the central record is important in that it forces focus on the right work - that which supports its success. Not understanding this could lead to poor system design, company distractions, and an incomplete experience for the user, to name a few.

The most common follow-up discussion to the Central Record article centered on two key points: first, the recognition that SORs exist across nearly every vertical, and second, how one could build a new SOR given this reality.

Conventional wisdom in Silicon Valley suggests that building a new SOR today is often too much to bite off for a startup—a notable counter-example being something like SHV/Altimeter-funded Everest, a new ERP (which raised a lot of money and was in stealth building for 4 years before launch - not your average startup). The recommended approach therefore is to start with a niche, high-ROI wedge product and build from there.

While this is certainly a viable strategy, the conversation got me thinking about others; in the paragraphs that follow I suggest seven strategies for how one might go about building a new SOR (around a central record) in a highly competitive landscape.

Differentiation is Table Stakes

Before getting into the strategies themselves, a potentially obvious statement: it's paramount that any new product has a clear point of differentiation from existing solutions in the market. Customers need to have a reason to care about a product - its “reason to exist” or “why now” statement must be compelling enough to overcome market inertia.

That is to say, the strategies themselves are only effective when paired with a differentiated product.

Differentiation can take many forms, including:

Leveraging a technology shift like AI, cloud, or mobile to offer capabilities that older systems lack.

Introducing a new value proposition that directly addresses pain points, such as Ramp saving businesses money or Moxie helping medspas start-up and grow.

Providing a new UX/UI paradigm that transforms user experience, like Slack did as an alternative to email or Figma did with multi-player mode.

Re-thinking the core persona and focusing on underserved users, such as Stripe focusing on developers or Canva for non-professional designers.

Taking advantage of regulatory shifts like Oscar Health did in response to the introduction of Obamacare.

Riding cultural trends that create new opportunities like Flagship empowering creators to sell products to their audiences.

Assuming a product has a strong point of differentiation, it can then pursue one of the strategies below to attempt to build a new System of Record in a crowded landscape.

Strategies for Building a New System of Record

Just below I provide a 10k foot overview of the 7 strategies, and then follow with a deeper dive into each.

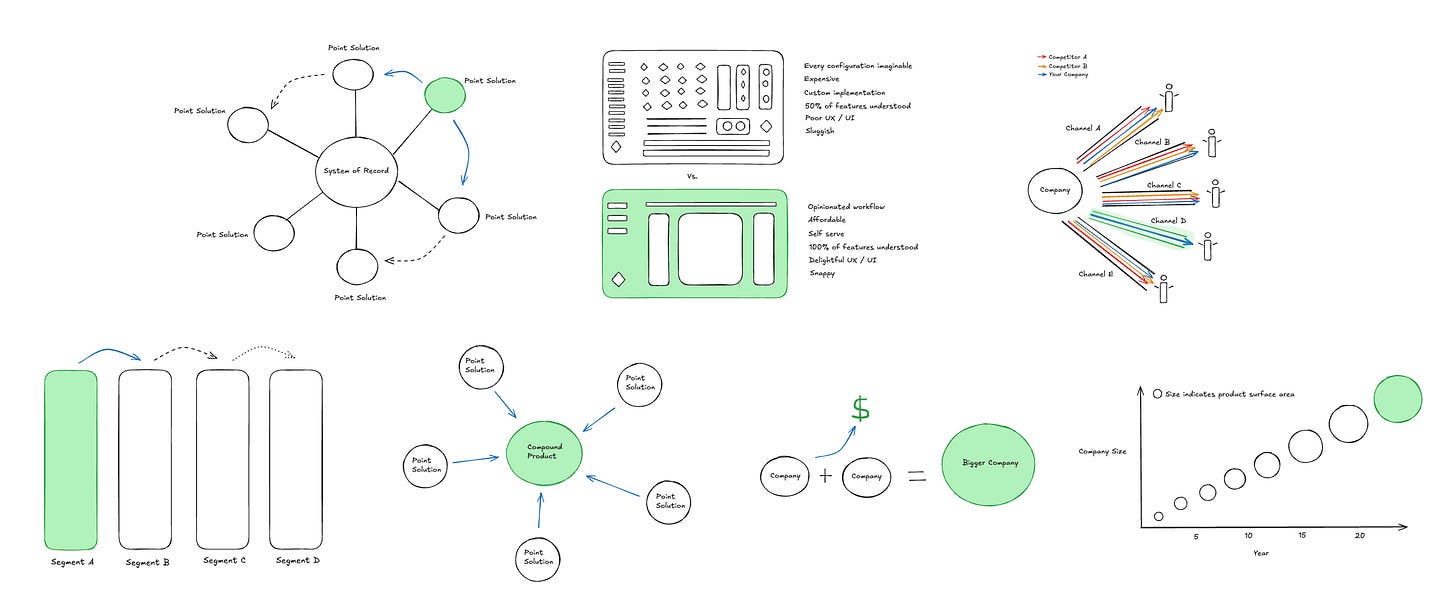

Integrate and Expand (Bite the Hand that Feeds): Start by integrating with an incumbent SOR as a point solution and gradually add more capabilities.

Hyper Focus and Expand (Or Not): Focus on a specific customer segment or vertical, then expand to additional segments (or stay within that niche if it proves to be big enough).

Rebundling: Create a bundled, well-integrated product that offers high quality solutions across multiple related categories.

Light Feature Set for Less Demanding Customers: Develop a solution with a lighter feature set that meets the needs of smaller or less demanding customers.

GTM Innovation: Innovate with a unique go-to-market strategy that can provide an edge over incumbents.

M&A Led: Use M&A to build a full-featured product offering.

Slow Burn: Take time to build a broad surface area product that grows gradually into a legitimate competitor.

An important note - these strategies aren’t necessarily mutually exclusive. Some of the most successful approaches may involve combining elements from multiple approaches.

Integrate and Expand (Bite the Hand that Feeds)

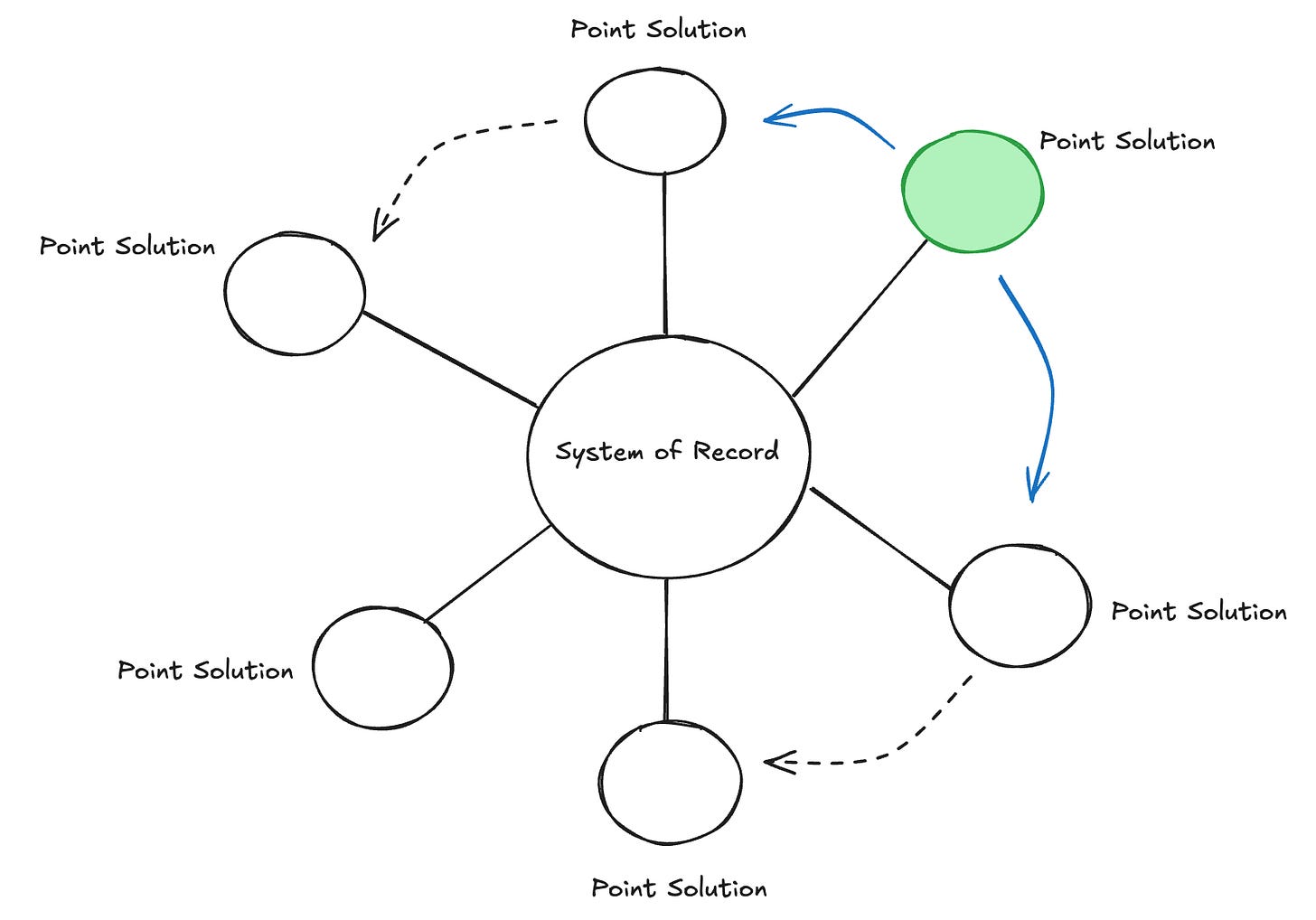

This strategy involves integrating with a core system of record as a point solution and then expanding the product with additional features / modules over time.

The goal is to eventually offer so much functionality that customers no longer see the need to pay for multiple redundant products. If the product is mature enough, customers may be willing to churn off their existing SOR altogether in favor of a comparable, but better, solution.

Perhaps the best example of a company who successfully managed this approach is Hubspot. Hubspot initially started as a marketing automation platform (the point solution) but gradually expanded its capabilities into sales and customer service. HubSpot integrated with other CRMs (like Salesforce) early on but eventually built its own full-featured CRM, giving customers an all-in-one solution.

The risk here is clear: a company taking this approach may end up "biting the hand that feeds" them. The core SOR allows them to exist and aids in distribution via their app marketplace / ecosystem. Expanding to surround the SOR would turn one’s company into a legitimate competitor, which may lead to the SOR removing API access and partner status. It’s rumored that Bill.com tried this by building their own GL but abandoned the project due to the associated risks. Ramp might follow a similar path in the Finance/Accounting space, but their strategy remains to be fully seen. Hubspot, meanwhile, has managed to keep its Salesforce integration, showing that if the right incentives remain in play, this strategy may not always result in the risk highlighted above.

The good folks at Tidemark have written about this strategy as well.

Hyper Focus and Expand (Or Not)

This approach focuses on coming to market with a hyper-focused product tailored to a specific segment, either a customer type or vertical. Over time, one can expand to other segments or decide to stay within the niche if it proves large enough. There are many successful software companies at scale today that remain single-vertical players (Toast, Clio, Procore).

Unlike the previous strategy, this involves launching with a product that has a large surface area from the beginning, aiming to be the SOR for the target segment from day one.

Lightspeed is a great example of a company who has successfully taken this approach. They started with a focus on brick and mortal retail businesses, and have over time expanded to serve restaurants and golf courses as well.

Drillbit is an example of a company who could take this approach. They’ve built an AI receptionist that helps home services businesses manage their back office. Once successful with this customer segment, they could expand to serve more mature businesses within or adjacent to their initial vertical.

Rebundling

Jim Barksdale famously said, "There are only two ways to make money in business: bundling and unbundling." After a proliferation of SaaS apps, customers are experiencing fatigue with numerous point solutions. This makes bundled or compound products attractive once again.

Rebundling involves taking point solutions and combining them into a single, well-integrated product. It’s the reverse of the well-known image showing the unbundling of Craigslist.

Rippling is a good example, where the integration of various modules is the key product feature. Posthog is another recent example, combining multiple categories into one solution.

Rather than competing head-on by copying an incumbent’s features, rebundling offers a best-in-class set of integrated modules. This approach focuses on quality integration rather than building a monolithic suite that’s just “good enough”.

Light Feature Set for Less Demanding Customers

Successful enterprise software can often become bloated and complex, making it difficult for smaller businesses to use. This opens up opportunities for lightweight, user-friendly alternatives.

These lightweight solutions are able to win against incumbents on multiple dimensions - price, time to value, usability, aesthetics, and more.

Attio is an example of a lightweight yet powerful CRM that’s easy to use, self-serve, and affordable, compared to Salesforce which is none of those. Other examples include Notion (an alternative to Office/G Suite), Linear (vs. Atlassian's Jira), Monday.com (vs. Microsoft Project), and Stripe (vs. traditional payment processors).

Once a foothold is established as a legitimate solution (even if less featured), additional “enterprise-grade” features can be added over time to cement a market position. The irony is that this new system may well become the bloated incumbent system of the future, but that isn’t a given history looks a lot more like a spiral staircase than a 2D circle anyway.

GTM Innovation

This strategy aims to create a unique and defensible go-to-market (GTM) motion that allows a company to win against established players. If executed well, a strong GTM strategy can provide enough momentum to break into a crowded space.

The company that acquired my startup, Sage (Intacct), used a unique GTM strategy that earned them credibility and distribution that the competition (notably Netsuite) could not match - an exclusive endorsement from the AICPA (American Institute of Certified Public Accountants). This became an “owned” channel that led to significant growth and continues to provide customers today.

The founders of Workday, David Duffield and Aneel Bhusir, were well-known enterprise-software industry-titans from their time building PeopleSoft. When the cloud presented an opportunity to build Workday, they leveraged their reputations and relationships to build Workday into the $64B behemoth that it is today. Even if competitors could match Workday’s product feature for feature, none could match the personal brands of their founders, providing a defensible opening to eventual incumbent status.

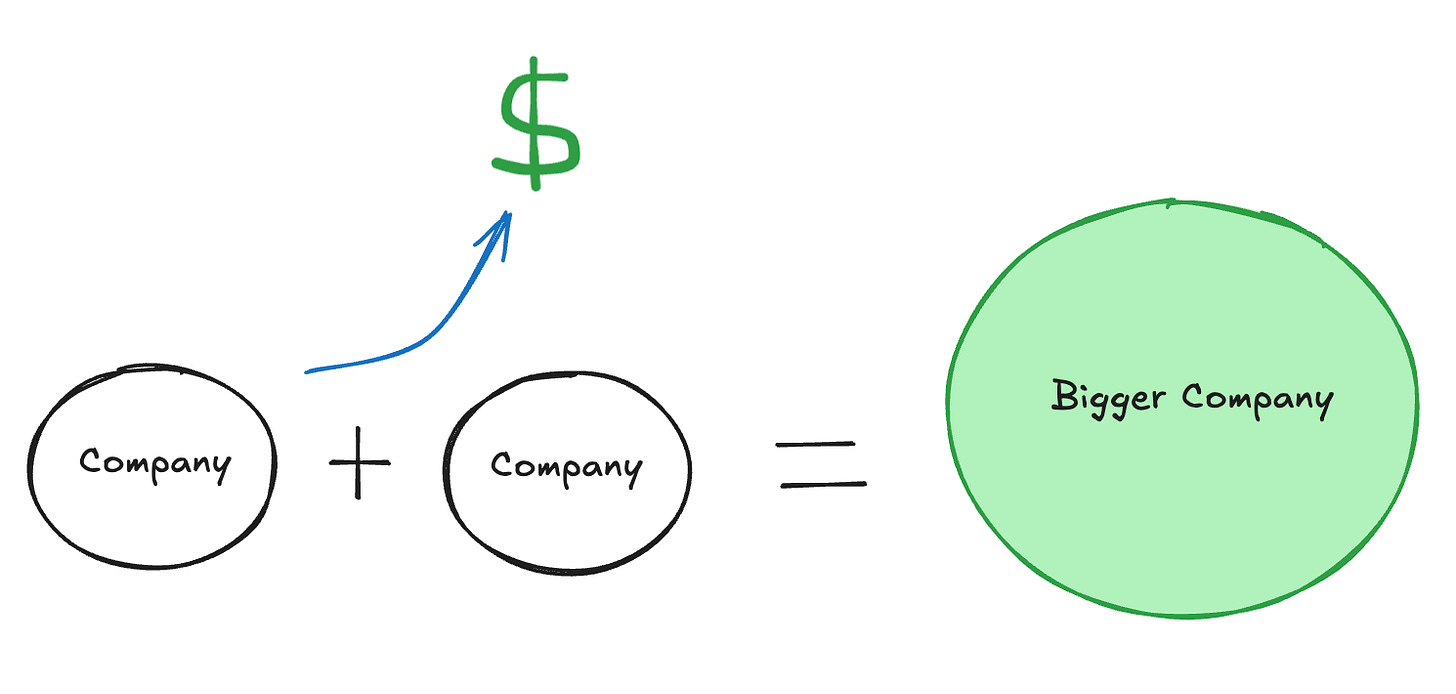

M&A Led

An M&A-led strategy involves acquiring companies to create a fully-featured solution. This approach may start from scratch or via an existing product with gaps. While not a hard rule, the former feels more like the realm of PE firms while the latter is an approach commonly taken by mid-late stage companies with a balance sheet that can fund acquisitions.

For instance, Netsuite acquired OpenAir to enhance its professional services capabilities, Workday acquired Adaptive Insights to strengthen its FP&A solution, and Ramp recently acquired Venue to build out its procurement product.

While not the perfect example of an M&A led approach to building a competitive SOR, in many ways this strategy reminds me of Slow Ventures’ Growth Buyout (GBO) thesis. Their GBO thesis advocates for buying a large incumbent business, improving it with modern technology, and then buying more incumbents in order to grow into a dominant player in a market. In case you missed it, they recently announced their involvement with Metropolis’s $1.5B acquisition of SP+, setting Metropolis up to be the largest parking operator in North America.

Although less realistic for a startup, one with a solid vision and the right capital partner(s) (like Metropolis) could use this approach to grow and compete against incumbents.

Slow Burn

The slow burn strategy involves taking time to build a legitimate competitor to incumbent solutions. Niche success provides capital to invest in product development, leading to more capital and further investment in building out a more robust product, and so on.

Zoho is a prime example of this approach. Founded in 1996, Zoho has never raised outside capital. Lacking external capital to fuel its rapid growth, it took Zoho over two decades to become a $1B ARR company. Today, however, they are a large and successful business, offering a wide range of products that compete with large incumbent enterprise software players.

The “slow burn” strategy offers durability, allowing a company to build both a trusted brand and a strong foundation over time. The concept aligns with the idea of slow compounding or the Lindy Effect, where the time taken to build a company correlates to its longevity. (It also should result in less founder dilution.)

If you’re patient, I happen to think this is a pretty great strategy.

Conclusion

In summary, any new product needs to have a reason to exist / clear differentiation to stand out in a crowded software landscape. If a company has that and their goal is to become an incumbent System of Record, I’ve proposed a few strategies for doing just that.

These strategies aren’t mutually exclusive—one could take a hyper-vertical-focused, integrate-and-expand approach to building the next Netsuite. In fact, the best ideas may lie in creatively mixing elements from the different strategies above (a nod to Matt Ridley’s “When Ideas Have Sex” explanation of innovation).

If you’re thinking about this broader topic and want to chat, reach out!