The Power of Central Records

A contrarian framework for thinking about sticky, venture-scale startup opportunities

In this Idea Series post, I'm excited to write about an idea that's been on my mind lately: building a Compound Startup around a Central Record. I think this is a useful yet contrarian (still) way to think about starting a big company today.

Let’s start with definitions. A Central Record is the foundational data structure or entity around which a business organizes its processes, products, and services. For example, Rippling, a fast-growing HR and IT platform, revolves around a single Central Record: the employee record.

Need to run payroll? It’s tied to employees. Performance reviews? Employees. Recruiting? Future employees. Benefits? Employees again. The employee record is the core around which Rippling’s entire business is built.

Rippling also exemplifies another concept: the Compound Startup. Coined by its founder and CEO, Parker Conrad, a Compound Startup is a company that builds “multiple products in parallel that are deeply integrated and seamlessly interoperable.” In Rippling’s case, these products—payroll, benefits, onboarding, and more—are tightly linked to the employee record as their Central Record.

This interplay between Compound Startups and Central Records is critical. By framing the Compound Startup model around a Central Record, we shift the focus from merely “building integrated solutions” to “logically integrating solutions around a central data model.” This framing clarifies how these solutions collectively advance a unified business or user goal. It also provides a framework for thinking about new opportunities around underserved Central Records.

Compound Startups built on top of a Central Record hold enormous potential: they create definitionally large opportunities, sticky products, and benefit from bundling economics.

Tossing Out Traditional Startup Advice

So why do I say this is a contrarian idea? Common startup advice is to focus on one thing, and do that thing better than anyone else. In the image below from SaaStr’s 2023 session with Parker Conrad on his theory of a “Compound Startup”, you see this advice on clear display.

Do a Google search for startups and focus and you’ll see hundreds of results repeating this common advice. And for good reason - startups have a fraction of the resources of large companies; to be successful, startups therefore need to focus.

However, in a world where there are an ever-increasing number of niche / point solutions focused on doing one workflow very well, opportunities exist in tossing this trite advice out the window and building a Compound Startup around a Central Record.

While there is nothing necessarily wrong with building a best-of-breed point solution, the market is starting to show some fatigue with this model.

After selling my startup to Sage, I spent 2.5 years speaking to Sage Intacct’s mid-market customer base. Throughout countless customer calls, a common theme began to emerge: Intacct customers used Intacct as the core solution but added point solution integrations for particular workflows that Intacct did not serve well. This gave them tools that facilitated one particular workflow (e.g. Accounts Payable) but left them with multiple vendors and data that wasn’t well integrated across their financial stack. They did not want a set of non-natively integrated point solutions bolted onto Intacct as their core Financial Management System (FMS) but they felt it was their only choice. They wanted “one throat to choke”, instead, they ended up with ten.

💡 In a world where there are an ever-increasing number of niche / point solutions, opportunities exist in tossing common startup advice to “focus” out the window and building a Compound Startup around a Central Record.

Again, this presents an opportunity for startups and founders who are capable and ambitious enough to take on building multiple solutions around a central record, à la Rippling.

Indeed, this compound approach is further proof that, as Jim Barksdale famously said, “There are only two ways to make money in business: one is to bundle; the other is to unbundle”.

Below, I explore a few types of Central Records that exist today, and the companies that are built around them.

A Few Central Records

For each of the examples below, I’ve included a description of the Central Record, example companies, and a screenshot that shows how these companies build integrated solutions on top of Central Records.

Financial Management Systems: Built around the general ledger (GL), this central record serves as the foundation for all financial transactions, providing a comprehensive view of a company's financial situation. It enables businesses to keep track of their expenses, revenues, and overall financial health.

Example companies: Sage Intacct, Netsuite

Customer Relationship Management (CRM): Built around the customer record, these systems integrate and manage customer data across different points of contact between the customer and the company. This centralized record includes contact information, accounts, purchase history, and interactions, helping businesses to improve sales, customer service, and marketing strategies.

Example companies: Hubspot, Salesforce

Electronic Health Records: Built around the patient record, these systems include medical history, diagnoses, medications, treatment plans, immunization dates, allergies, radiology images, and lab test results. This centralization improves the quality of care by ensuring that accurate and up-to-date information is accessible to healthcare providers.

Example companies: Epic Systems, Cerner

Project Management Software: Built around the project record, these systems encompass task assignments, deadlines, progress tracking, resource allocation, budget management, and communication logs. This centralization enhances efficiency and collaboration by ensuring that all project stakeholders have access to the most current project information.

Example companies: Monday.com, Atlassian, Asana

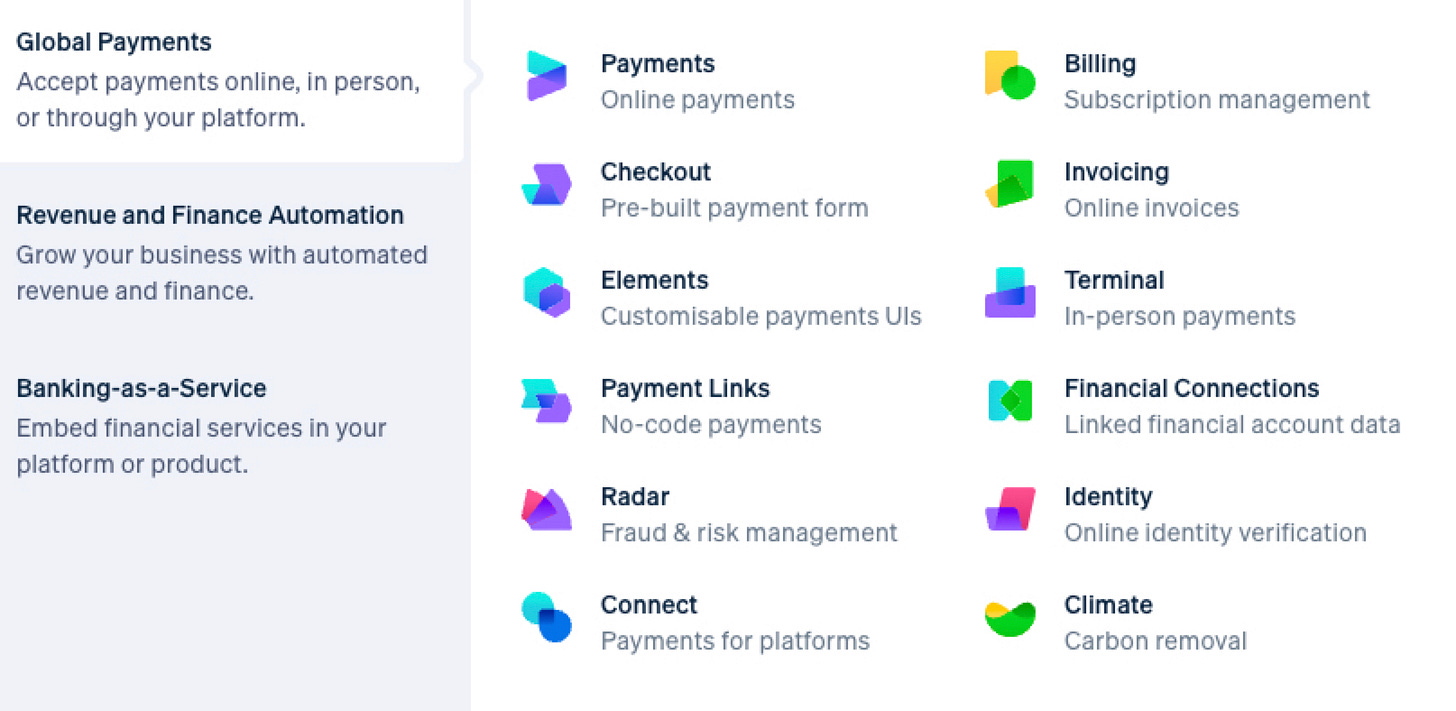

Payments Companies: Built around the transaction record, these systems manage payment processing, fraud detection, customer and merchant accounts, POS solutions, and more. This centralization streamlines the transaction process, enhancing the security and efficiency of online payments for businesses and consumers alike.

Example companies: Stripe, PayPal, Square

[To be determined] Blockchain Companies: Built on blockchain ledgers, which are immutable and decentralized records of transactions, these companies seek to ensure transparency, security, and integrity of data across various applications beyond just cryptocurrencies, such as smart contracts, digital identities, and supply chain management. As the technology matures, I anticipate that a plethora of solutions will emerge around the central blockhain ledger record.

Opportunities Abound

Compound Startups built around Central Records stand to benefit in the following ways:

These businesses are definitionally large, venture-scale opportunities. This should make fundraising and hiring talented people easier.

Owning the Central Record itself puts them in a strong position. They will have a long and fruitful product roadmap including all of the ancillary workflows and services that their customers need, leading to additional products, additional revenue, and better retention. (To see this in action, read this post on Stripe, which released 2 products in its first 5 years (core payments), and 9 in its second 5 years (built on top of payments).) It’s hard to justify ripping out a software solution that is built around a Central Record (given the often core nature of the record + many solutions built around it), even during times of austerity.

This model lends itself to bundling economics. Once you’ve acquired a customer, you can afford to sell an additional solution for less than your point-solution competitor because you have no new CAC expense on that additional sale. (See MS Teams vs. Slack growth as an example of the power of bundling.)

There are many billions in market cap up for grabs for those who can devise a clear vision, raise substantial capital, and hire a stellar team to build a Compound Startup on top of a Central Record.

This might seem a lot harder than building a narrow / point solution startup. It is. However, as Sam Altman rightly calls out in this short clip below, it’s often counterintuitively easier to start a hard company than an easy one.

A few Central Records that I believe are worth exploring:

Finance - the general ledger & its related workflows

Travel - the travel itinerary & its related worfklows

AI - is AI a valid “why now” technology that enables new compound startups built on central records?

Blockchain - the blockchain ledger & what can be built around it

If you’re interested in this idea and want to jam on it with someone, drop me a note, I’d love to dig in with you.

- Erik

Very interesting, thanks!